It’s too early to celebrate any wins (e.g. progress on In this Quarterly Edge episode of Blue Chip NOW!, hosts Daniel Dusina, CFA® and Dan Seder, CFA®, CMT, CFP® explore the current uncertainty of the economy, sharing their thoughts on why it’s challenging to be either optimistic of pessimistic in this ever-changing landscape.

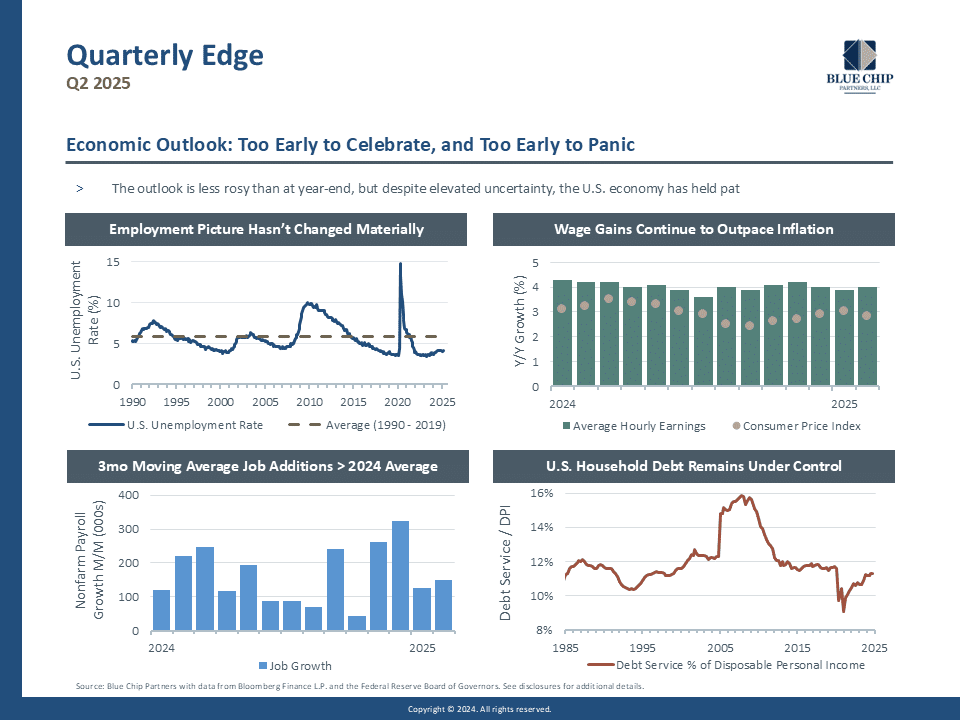

They discuss key topics like the labor market, new job opportunities, wage gains, and how the wealth effect is shaping consumer behavior. The hosts also take a closer look at the level of debt in U.S. households and what it means for future spending power.

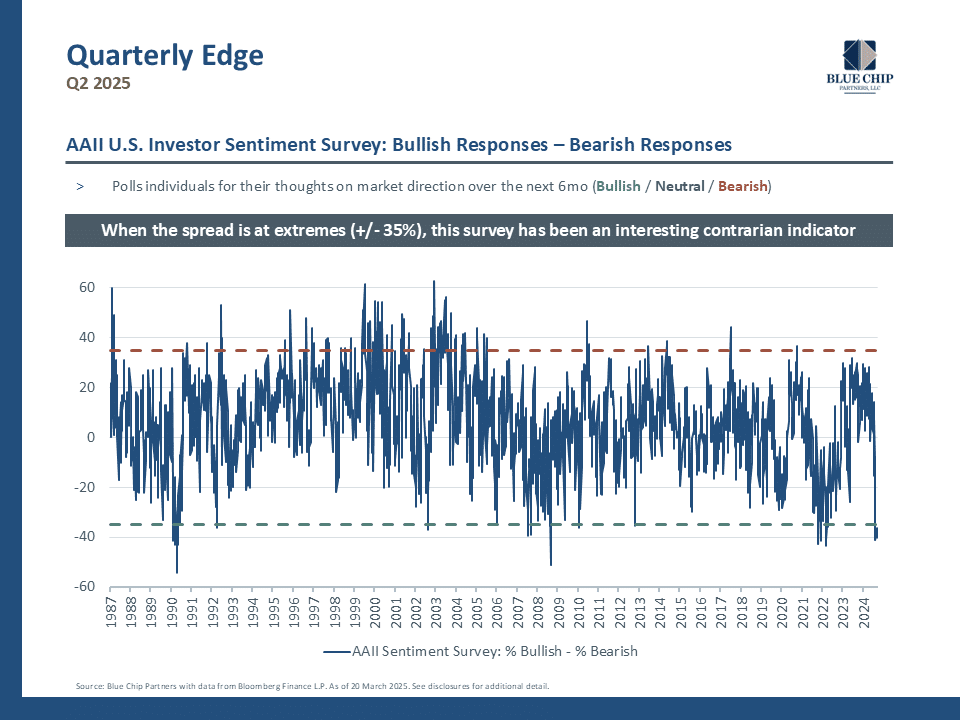

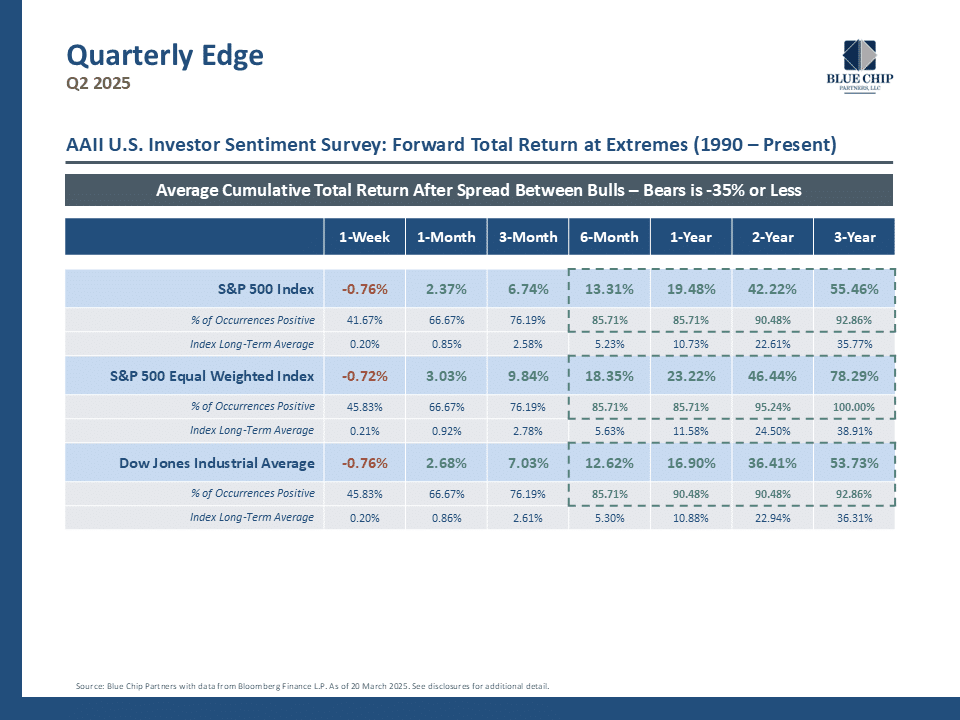

In addition, Daniel and Dan analyze the stock market and offer their expectations for the shape of market performance over the coming quarters. They also highlight investor sentiment as a crucial indicator, referencing the AAII U.S. Investor Sentiment Survey.

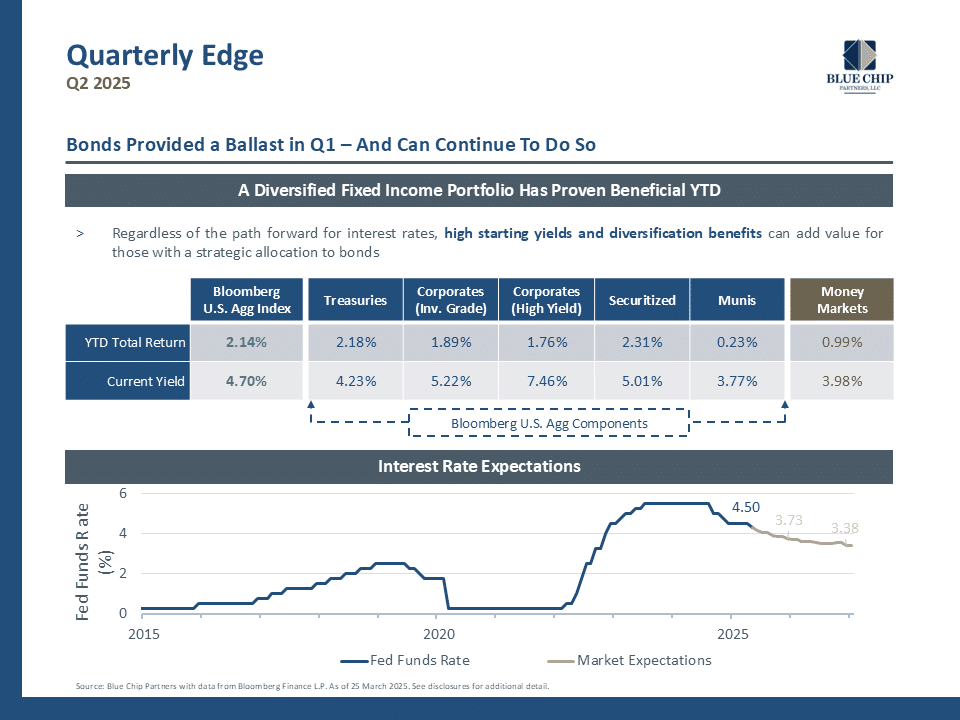

This episode also touches on investor and client concerns, giving insights into the bond market, which has provided a ballast amid a volatile period for stocks.

Economy

Stocks

Bonds

Admittedly, our outlook for the U.S. economy today is less optimistic than it was at the start of the year. Uncertainty has weighed on consumer spending, and messaging from corporate leaders has implied a more cautious approach to capital deployment going forward. That said, we believe it is too early to sound the alarm, especially as the bigger picture as it pertains to the economy is yet to show signs of meaningful cracks. Zooming out an be helpful at this juncture.

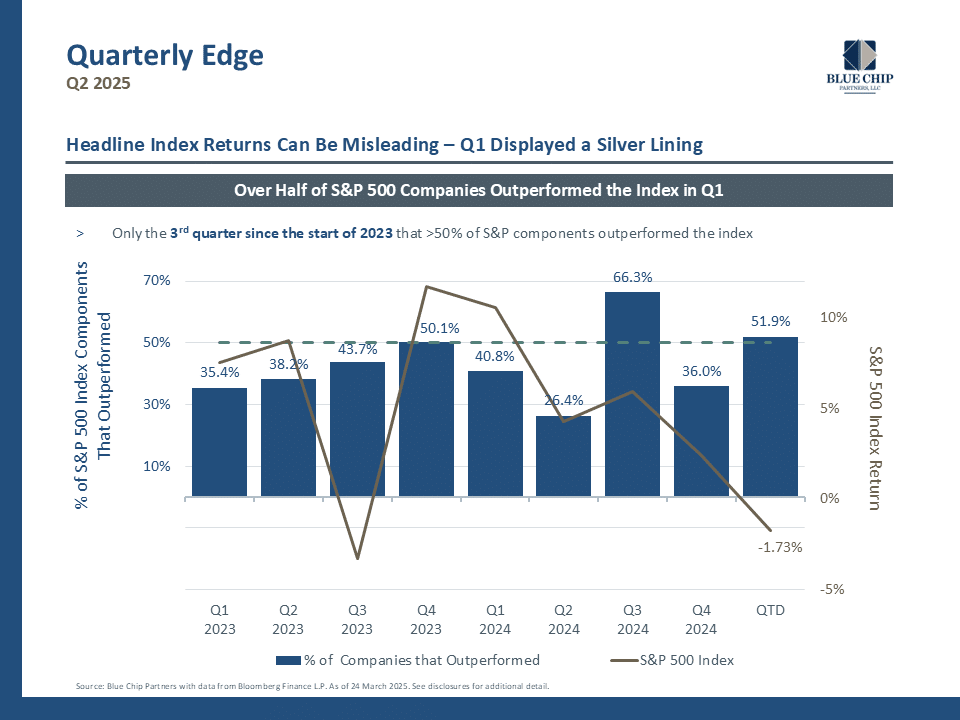

The S&P 500 Index printed a negative quarterly return for the first time since Q3 2023. However, a silver lining can be found in the fact that market performance appeared more diversified than we saw in aggregate across calendar years 2023 and 2024. Q1 2025 was only the 3rd quarter since the start of 2023 the over half of S&P 500 companies outperformed the index. A broadening out of market returns can be indicative of a healthier market.

We believe that investor sentiment, such as that collected by the American Association for Individual Investors’ (AAII) Sentiment Survey, can provide helpful information. Based on historical data, we see this survey as a contrarian indicator, meaning that forward returns when investor sentiment is overwhelmingly bearish (pessimistic) have outpaced those seen after sentiment is overwhelmingly bullish (optimistic). Investor sentiment tends to be reactionary, meaning investors become more pessimistic after the market has already experienced downward pressure.

Using the S&P 500 Index as an example, when the percentage of bearish respondents outnumber those that are bullish by 35% or more, the average forward returns have generally outpaced those implied by the long-term average of the index. “Be fearful when others are greedy, and greedy when others are fearful,” said Warren Buffett, which we would view as directly relevant when analyzing investor sentiment.

In a period of equity volatility, bonds provided a ballast in Q1 2025. Given that we see potential for a bumpy ride as we progress through the remainder of 2025, a diversified bond allocation can be in position to continue to add value to portfolios in which an allocation to fixed income is appropriate. Money market fund rates remain elevated, but may face downward pressure if the Federal Reserve implements the 2 rate cuts expected by members this year. Instead of going “all in” on one portion of the fixed income market, a diversified bond portfolio can provide a starting yield over and above that of a money market fund. Starting yields have historically exhibited high correlation with long-term returns in the bond market, and instead of handicapping returns as they would for money market funds, rate cuts can benefit a traditional bond portfolio as interest rates and bond prices are inversely correlated.

Our wealth management team is ready to help you get the most life out of your wealth. If you have a portfolio of at least $500k, please give us a call. Click here to get started.

Privacy Policy | Terms & Conditions | Disclosures

Copyright © 2024 All rights reserved.