Market Outlook

What a year. It feels fair to say that an investor’s favorite aspect of 2022 is that it is now in the rearview mirror. As inflation notched multi-decade highs, a markedly flat-footed Federal Reserve hiked interest rates at a pace never previously experienced by the domestic market, which severely pressured prices across equity and fixed income securities. Thus, the traditional 60/40 portfolio is on pace to lock in its worst calendar year of performance since 1937.

So, where to from here? As we enter 2023, we have observed two arguments that comprise consensus sentiment within the domestic retail investor base:

1. Since interest rates are still expected to rise, bonds are unattractive.

2. A recession will hamper corporate earnings, meaning there is no upside in stocks.

To us, the stances above are too generalized. From our perspective, bonds look increasingly attractive relative to stocks, but we are not outright negative on the latter. Within both equities and fixed income, greater scrutiny on allocations is required as economic pressures mount.

1. Are Bonds Back?

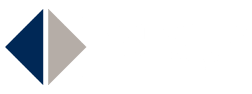

If you will recall from our Q4 2021 Quarterly Edge, investors can utilize the Equity Risk Premium (ERP) to gauge the relative attractiveness of equities and fixed income. Calculated as the difference between the S&P 500’s earnings yield (earnings per share / price per share) and the U.S. 10-Year Treasury yield, when high, the ERP denotes that investors are fairly compensated for taking on additional risk in equities. When low, the ERP dictates that fixed income securities pose a better the value proposition.

In 2022, the earnings yield expanded, but the 10-year Treasury yield rose significantly more. More specifically, the “risk-free rate” that is represented by the 10-year Treasury yield increased nearly 40% as of this writing, which had a knock-on effect to the broader fixed income market. Today, the Equity Risk Premium resides at a level not seen since 2009, While we are at a point that is technically “average” over the last 30 years, the simple fact is that investors are finally getting paid to allocate to fixed income securities by way of higher coupon payments. Should we see broad pressure on earnings and further upside to interest rates in Q1, the ERP will compress further, increasing the attractiveness of bonds.

2. Blue Chip Debt

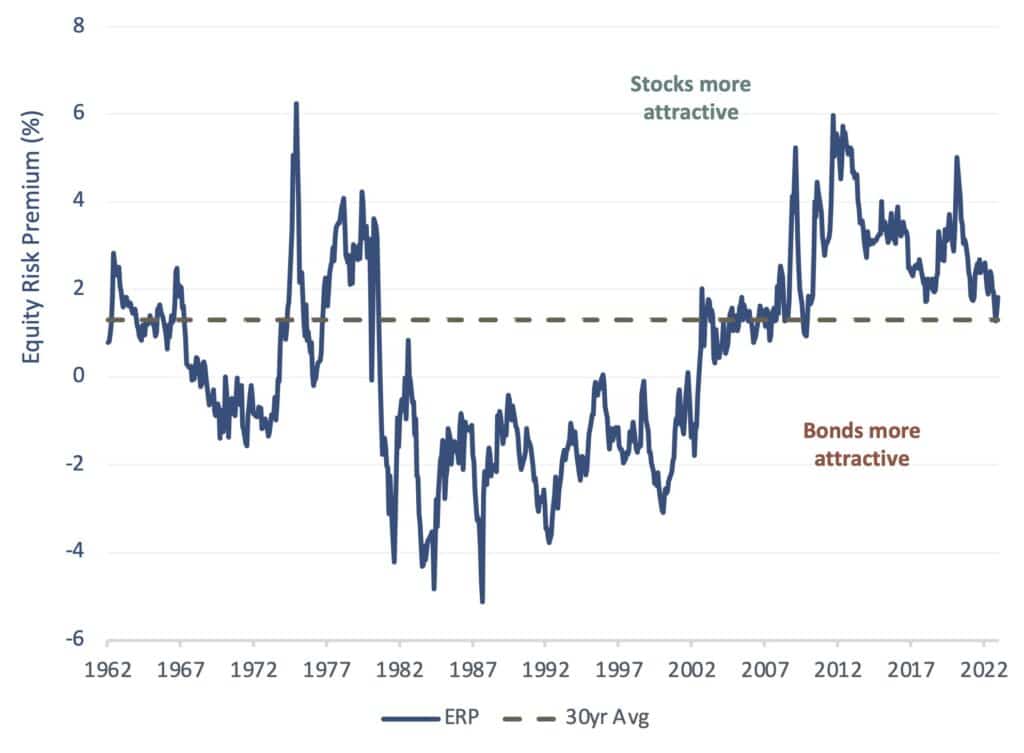

The increase in baseline interest rates can be seen across the fixed income market. While we entered 2022 in an environment which dividend-paying stocks provided greater distributions than most of the bond market, income-oriented investors are now spoiled for choice within fixed income.

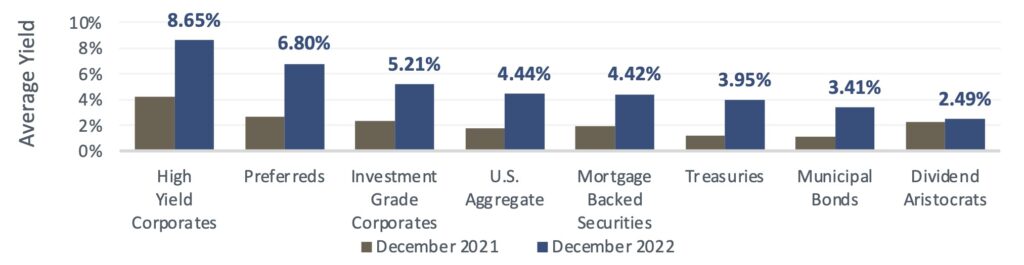

However, we are selective with regards to our preferred positioning in fixed income. At this juncture, we are cautious on high yield bonds, and more constructive on investment grade and municipal bonds. While U.S. Treasury bonds are essentially riskless, other securities come with varying levels of risk, for which investors must be compensated by way of higher interest payments. This additional yield above the risk-free rate is called the spread. High yield bond issues display lower credit quality, and thus investors require greater compensation for higher risk of default. With escalating economic weakness, we are surprised that high yield spreads have actually compressed over the last 6 months. In fact, where the average high yield bond trades today (~13% discount to par), history denotes that the average spread has been close to 8.0%, significantly wider than the 4.7% shown today. High yield is further complicated by the fact that issuer credit quality in the space is worsening, evidenced by an increase in the percentage of issuers with S&P credit ratings of B- or below. To solidify our thoughts, high yield has historically underperformed other fixed income subsets in the 12 months after the 3-month/10-year Treasury spread turned negative, which occurred in October. Remember – bond yields and prices have an inverse relationship, and as we see potential for a slowing economy to lead to wider spreads next year, we are waiting for a more attractive entry point before increasing exposure to high yield.

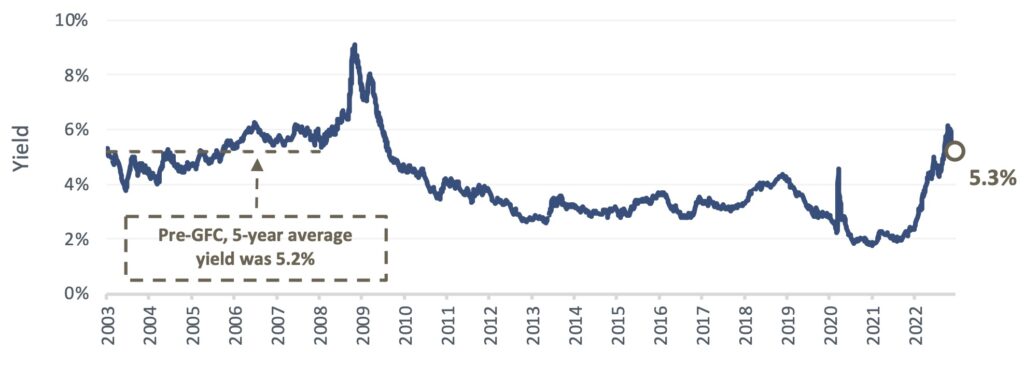

Instead of reaching for risk in fixed income, we see both value and prudence in moving up the quality spectrum. Investment grade bonds, which are issued by the higher-quality, “Blue Chip” companies of the market, offer yields not seen in the space since before the Global Financial Crisis. These firms pose little default risk, and although we are not calling for a slew of high yield defaults, we have yet to see the impact that tighter financial conditions will have on domestic businesses. Thus, the enticing combination of resilience and income found in Blue Chip Debt is well-suited for portfolios at this point in the cycle.

Also in the Blue Chip Debt conversation are municipal bonds. State revenues have increased in all but one U.S. state over the last year, and surging tax collections bode well for the finances of state and local governments. Defaults are at their lowest since the GFC, and credit rating upgrades have been outpacing downgrades since the start of the pandemic. Further, municipal bond ratings were mostly unchanged in past recessions given nature of tax collection. The tax-advantaged aspect of munis are important – although they do not offer the highest level of income in absolute terms, tax-equivalent yields have rarely been higher over the past 15 years.

3. Taking Stock

To be sure, earnings are a vital component of security analysis within the equity market. They are not, however, the only component. An understanding of what market participants may be willing to pay for a share of said profitability or sales (valuation) is ultimately what drives stock prices.

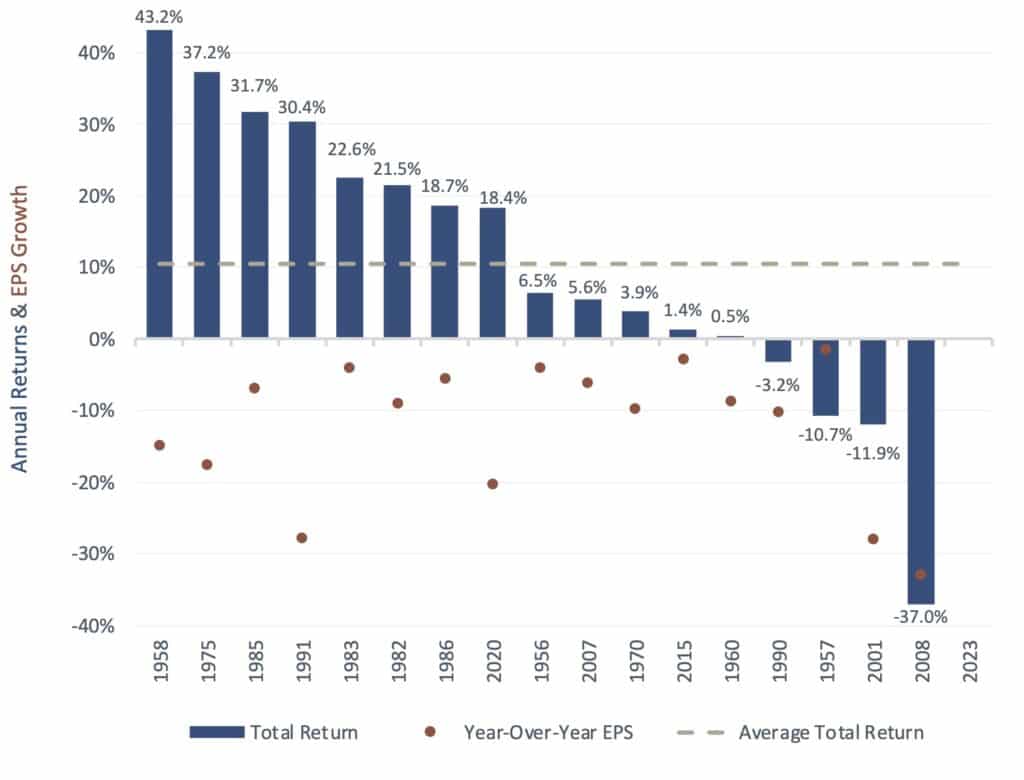

We believe that consensus earnings estimates for 2023, currently at +3.0% for the S&P 500 Index, are too ambitious. Especially within a sector like consumer staples, where companies’ recent growth has stemmed largely from passing on higher prices to consumers as opposed to the generation of higher volumes. As inflation decelerates, the price realization tailwind disappears. However, even if negative earnings revisions come through as we expect, stock prices do not exhibit a 1:1 correlation with profitability. For arguments sake, let’s assume headline earnings (EPS) decline year-over-year. Since 1955, the S&P 500 has exhibited a positive annual return in 13 years in which EPS growth was negative. This compares to just 4 years in which the S&P ended the year in the red on lower earnings. Overall, the average return during years with negative year-over-year EPS growth is +10.5%. It is not unusual for the S&P 500 to end a year higher despite earnings pressure as stock prices reflect expectations for the future, not just the current year.

As mentioned previously, the price that a market participant is willing to pay for participation in a company’s revenue and profits ultimately drives stock prices. Within fundamental analysis, investors look past just the here and now, sometimes far into the distant future to arrive at what the fair value of a company is believed to be. This is the backbone of equity valuation. When company-specific or economic aspects like inflation are expected to deteriorate corporate productivity, investors will be hesitant to pay up for what is a less-certain outlook. Further, in periods of higher interest rates, the opportunity cost for market participants is greater. Equity investors forego the opportunity to invest in now higher-yielding risk-free assets, which means investors need to believe that the businesses they are putting money towards will generate financial productivity over and above the risk-free rate.

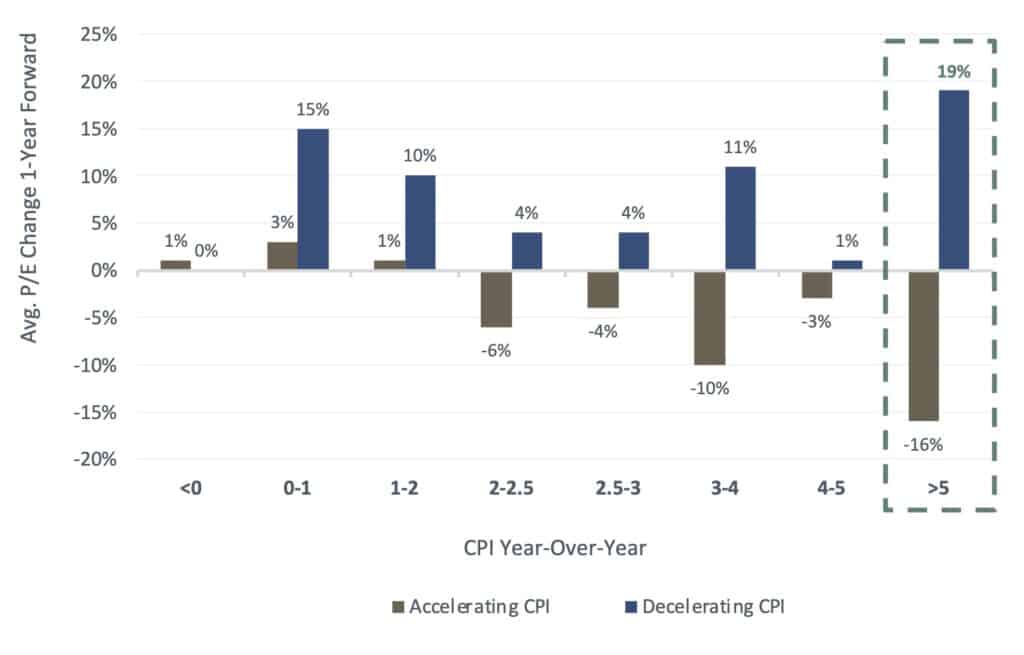

In periods of accelerating inflation, it is challenging for companies to prove their worth to investors. Rising input costs, unless passed on to consumers, equate to lower expected profitability, which impacts the price an investor is willing to pay for participation. The exact opposite is true in periods of falling inflation, and this is where we find ourselves today. Inflation has peaked, and we believe the Consumer Price Index (CPI) is slated to fall meaningfully in 2023. With less of a deterrent to future profitability, valuations can expand despite lower current year earnings. History shows this to be the case, and although there are other economic considerations, removal of a focal headwind from 2022 will be of significance for equity investors.

So, what does this mean for us today? Well, in April of 2022, we hit a level of bearishness relative to bullishness that hasn’t been seen since 2009. After a brief period of reversion through June and July, which, mind you, coincided with very strong equity market returns. We now find ourselves at a key threshold, which is where bearish observations outpaced bullish observations by 35 points. So, based on history, this is a compelling observation for us.

Download the full Q1 2023 Report below to get more insight from Blue Chip Partners.